Fraud offences Defence Barrister

Master complex financial crime defence. Charlie unravels corporate fraud, investment schemes, and multi-jurisdictional conspiracies. Exceptional at cross-examining forensic accountants and exposing flaws in prosecution cases involving millions in alleged losses.

Contact CharlieFraud Offences – Expert Defence for Complex Financial Crime

Why Instruct Charlie Sherrard KC for Fraud Defence?

Fraud allegations strike at the heart of your reputation, career, and financial security. Complex financial crime prosecutions involve millions of documents, forensic accounting evidence, and multi-jurisdictional investigations. Charlie Sherrard KC brings unmatched expertise to fraud defence:

Mastery of Complex Evidence

Charlie excels at deconstructing prosecution cases involving thousands of pages of financial records, banking transactions, and accounting analyses. He identifies weaknesses in forensic accounting methodologies and exposes gaps in the Crown’s understanding of legitimate business operations.

Devastating Cross-Examination

Forensic accountants and financial investigators often present simplified narratives that ignore commercial reality. Charlie’s incisive cross-examination exposes their assumptions, challenges their conclusions, and reveals innocent explanations for transactions the prosecution characterizes as fraudulent.

Multi-Handed Conspiracy Expertise

Fraud conspiracies frequently involve multiple defendants with competing interests. Charlie navigates the strategic complexities of multi-handed trials, protecting your position while managing cut-throat defences and prosecution attempts to use co-defendants against each other.

Corporate and Investment Fraud Specialism

From corporate accounting fraud to Ponzi schemes, carbon credit frauds to cryptocurrency scams, Charlie understands the commercial context in which allegations arise. This allows him to present your conduct within legitimate business frameworks rather than the prosecution’s criminal narrative.

Regulatory Interface Understanding

Many fraud prosecutions involve parallel regulatory investigations by the FCA, SFO, or insolvency practitioners. Charlie manages the interface between criminal proceedings and regulatory enforcement to protect your interests across both spheres.

Notable Fraud Defence Cases

While specific cases often involve reporting restrictions or client confidentiality, Charlie’s fraud practice encompasses:

- Corporate accounting fraud involving allegations of false financial statements and misrepresentation to investors

- Investment fraud including Ponzi schemes, boiler room operations, and unauthorized collective investment schemes

- Carbon credit fraud prosecutions arising from the VAT fraud scandal affecting emissions trading

- Cryptocurrency fraud allegations involving digital asset trading platforms and token offerings

- Banking fraud including mortgage fraud, loan fraud, and fraudulent trading

- Long-firm fraud cases involving the acquisition of goods without intention to pay

- Procurement fraud within public sector and commercial supply chains

Areas of Expertise in Fraud Defence

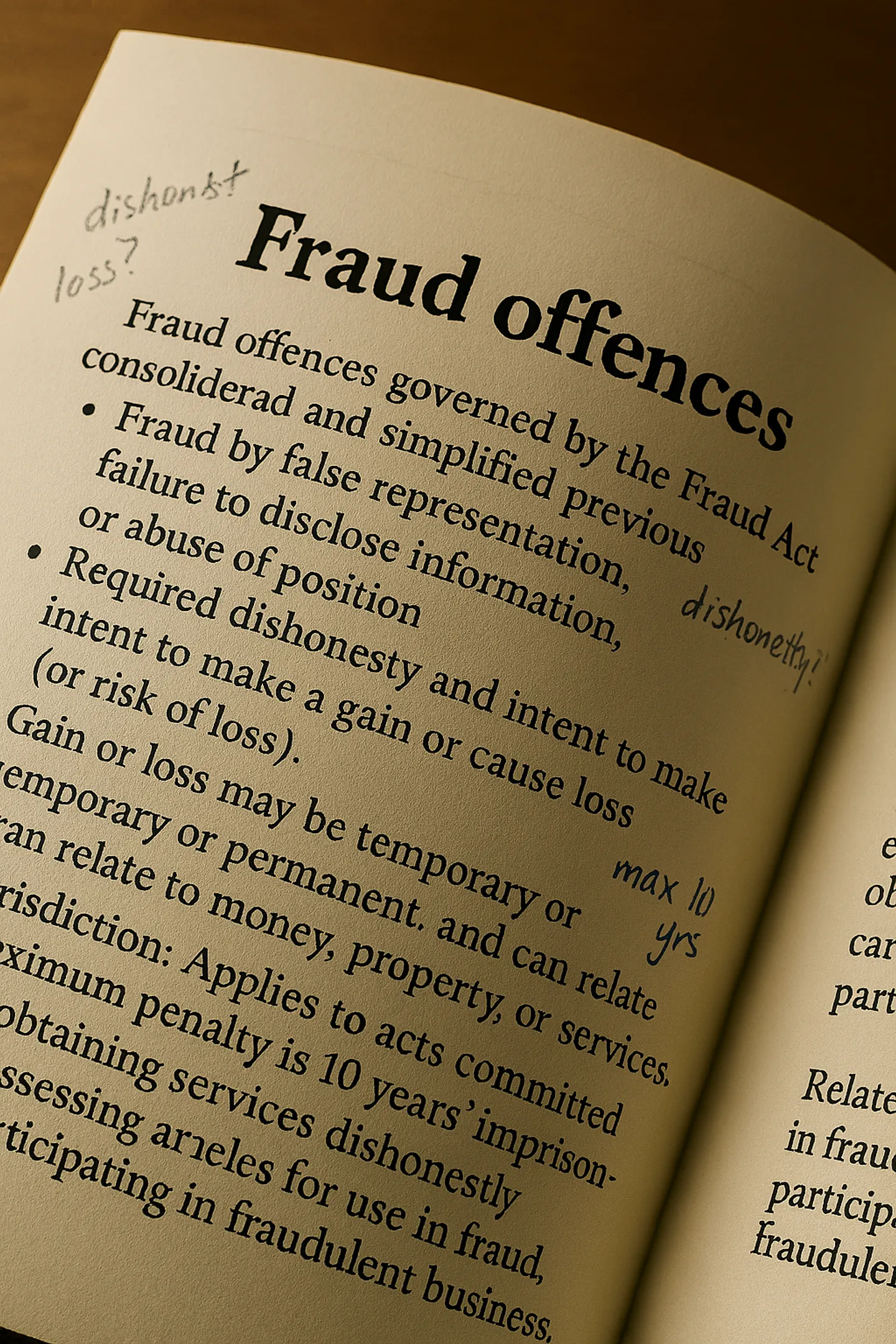

Fraud by False Representation (s.2 Fraud Act 2006)

The most commonly charged fraud offence, requiring proof of dishonest misrepresentation. Defence strategies focus on challenging dishonesty, proving belief in truth of representations, and demonstrating lack of intent to gain or cause loss.

Conspiracy to Defraud (Common Law)

Used for complex frauds where statutory offences don’t adequately capture the conduct. Defence involves challenging the scope of the alleged agreement, proving withdrawal, and demonstrating absence of dishonest intent.

Cheating the Public Revenue

Serious allegations of tax evasion and VAT fraud prosecuted by HMRC. Defence requires sophisticated understanding of tax law, distinguishing tax avoidance from evasion, and challenging HMRC’s interpretation of complex transactions.

Money Laundering

Often charged alongside substantive fraud offences. Defence strategies include proving lack of knowledge or suspicion that property represents proceeds of crime, demonstrating authorized disclosure, or establishing adequate consideration defences.

Proceeds of Crime

Confiscation proceedings follow fraud convictions. Charlie protects clients from disproportionate confiscation by challenging benefit calculations, establishing legitimate sources of wealth, and proving availability constraints.

Financial Services Offences

Unauthorized financial services activity, misleading statements, and market abuse charges brought by FCA. Defence requires navigating the regulatory framework and challenging the prosecution’s interpretation of financial services regulations.

Recognition in Fraud Cases

Chambers UK describes Charlie as “exceptionally good on his feet” and notes his “ability to master complex financial evidence.” He is “highly skilled at cross-examining expert witnesses” and “excels in multi-handed fraud trials.”

Legal 500 recognizes Charlie’s “forensic approach to case preparation” and his “ability to explain complex financial concepts to juries in ways that create doubt about the prosecution’s case.”

Instructing solicitors praise Charlie’s “strategic thinking in conspiracy cases where multiple defendants have competing interests” and his “skill at protecting clients while navigating the dangers of cut-throat defences.”

The Fraud Defence Difference

Early Intervention

Fraud investigations often span years before charges are brought. Charlie advises on police interview strategy, voluntary interviews under caution, and engagement with regulators during the investigation phase to minimize exposure.

Expert Evidence Strategy

Defence forensic accountants can be crucial in fraud trials. Charlie works with leading experts to challenge prosecution accounting methodologies, provide alternative interpretations of financial evidence, and demonstrate legitimate explanations for transactions.

Jury Communication

Fraud trials risk overwhelming jurors with financial complexity. Charlie presents defences in clear, accessible language that helps juries understand commercial reality and see reasonable doubt in the prosecution’s simplified narrative.

Sentencing Mitigation

Fraud sentencing depends heavily on loss/intended loss amounts. Charlie challenges loss calculations, proves recoverable losses, and presents mitigation emphasizing genuine commercial activity, lack of lavish lifestyle, and personal mitigation that can substantially reduce sentence length.